- Tenant experienced negative financial impact due to COVID-19.

- Tenant is at risk of experiencing homelessness or currently experiencing housing instability due to COVID-19 (for example: struggling to pay their rent and/or has rental arrears, past due utilities).

- Tenant has not received Treasury Rent Assistance before.

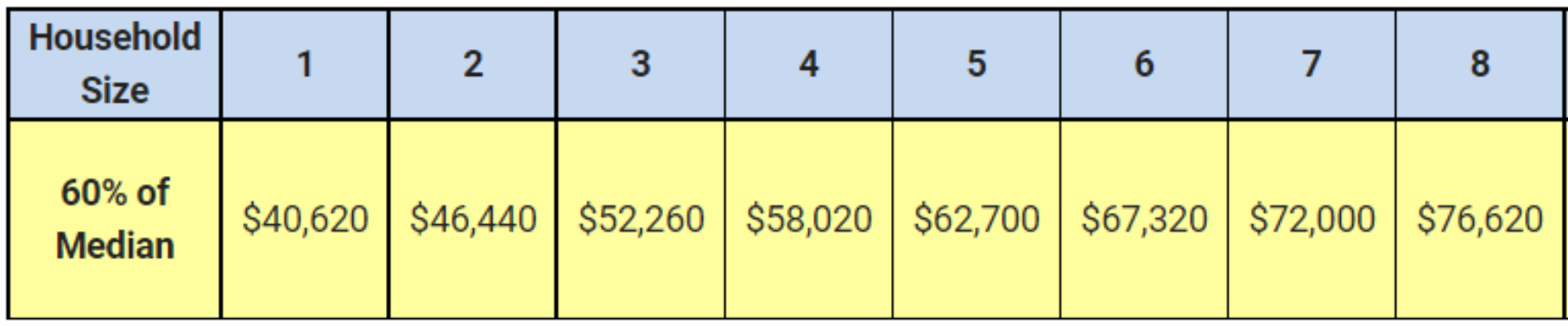

- Tenant income is 60% of the Area Median Income (AMI) or below- See below for chart

Please note, being placed on the waitlist does not guarantee assistance.

Are you facing eviction? Click the buttons to the right to read the information in English or Spanish.

For additional information on eviction prevention, click here.

Eligible incomes and allowed expenses (all adults over 18):

Use the chart below to see if you are income-eligible.

* Supplemental unemployment income and the stimulus funds issued during the COVID-19 pandemic are excluded for the purpose of income eligibility.

Assistance Details:

- Eligible households can receive up to 12 months total of rent assistance. This includes:

- Struggling to pay their rent, beginning March 13, 2020, for up to 12 months maximum.

- Up to three months of future rent, maximum.

- Please know that resources are limited, and it may take months to receive assistance, if placed on the waitlist.

This assistance can also be used for the following needs, including:

- Manufactured home rental space “lot rents,” or RV space for primary housing.

NOT ELIGIBLE

Mortgage payments. (If you need assistance with your mortgage, you can check-in with St. Vincent DePaul – Vancouver and The Salvation Army Vancouver who may have very limited mortgage assistance).DEMAND WILL EXCEED AVAILABLE ASSISTANCE

COVID-19 has negatively impacted many more households than the funding available for Treasury Rent Assistance will be able to assist. While we will continue to encourage Federal and State partners to provide additional funding, meeting eligibility requirements will not guarantee access to assistance. We strongly encourage all households facing potential eviction to continue exploring all potential options.Landlords Seeking Access to Rent Assistance Programs on Behalf of Tenant

If a tenant refuses to engage with the housing agency, or they do not qualify for rental assistance, and the landlord owns no more than 4 rental units, the landlord may qualify for assistance. More information about the program is available at https://www.commerce.wa.gov/serving-communities/homelessness/landlord-fund-programs/.

Documents to Collect for Assistance:

- Fully Signed Lease or Rental Agreement (Landlords willing to attest to a rental may qualify if documentation does not exist).

- An Eviction Notice (if received- don’t ask for one).

- Past due Utility Notice

- Verification of income for the last two months (for example: pay stubs, W-2, payment statements, tax filings, bank statement showing regular income, payment statements).

- Income may include earned income, unemployment payments, TANF Funds, Social Security, self-employment, armed forces income, pension/retirement income, alimony, child support, foster parent/care payments.

- Households do not need to have a Social Security Number or Documentation Status.

- In addition, landlords will be asked to complete a current W-9 and sign an agreement verifying information. Provider agencies will send that form to landlords or property managers and work with them directly on your behalf.

“This project is being supported, in whole or in part, by the federal project under Section 501 Emergency Rental Assistance awarded both directly to Clark County and through the Washington State Department of Commerce. Points of view are those of the author and do not necessarily represent the official position or policies of the US Department of the Treasury.”